While PayPal has acted as “moral police” for over a decade,1 in the last couple of years, its true purpose has crystallized. You probably thought PayPal was nothing more than an online payment service, but its true function is as a politically biased extremist-activist platform. PayPal’s chief executive Dan Schulman himself has publicly stated he was “born with social activism in my DNA.”2

Natural health organizations, antiwar journalists,3,4 Christian organizations,5 anti-child-grooming organizations,6 nonprofits fighting vaccine mandates, organizations promoting early COVID treatments, alternative media7 and free speech unions8 are just a sampling of the individuals and groups that have had their PayPal accounts cancelled without warning.

PayPal Is Stealing Funds

Adding insult to injury, PayPal is also seizing any money you might have in your account on the day of deplatforming. As reported by independent journalist Matt Taibbi in May 2022:9

“In the last week or so, the online payment platform PayPal without explanation suspended the accounts of a series of individual journalists and media outlets, including the well-known alt sites Consortium News and MintPress …

Consortium editor Joe Lauria succeeded in reaching a human being at the company in search of details about the frozen or ‘held’ funds referenced in the note. The PayPal rep told him that if the company decided ‘there was a violation’ after a half-year review period, then ‘it is possible’ PayPal would keep the $ 9,348.14 remaining in Consortium’s account, as ‘damages.’

‘A secretive process in which they could award themselves damages, not by a judge or a jury,’ Lauria says. ‘Totally in secret’ … This episode ups the ante again on the content moderation movement … where having the wrong opinions can result in your money being frozen or seized. Going after cash is a big jump from simply deleting speech, with a much bigger chilling effect.”

PayPal’s Terms of Service: $ 2,500 Fine for Misinformation

On top of its deplatforming of political opponents and freezing their funds, PayPal recently threatened to fine users who express opinions that the company doesn’t agree with.10,11,12 In other words, they’ve devised yet another way of stealing your funds, even if they don’t seize your entire account and close it down. As reported by the DailyWire November 7, 2022:13

“A new policy update from PayPal will permit the firm to sanction users who advance purported ‘misinformation’ or present risks to user ‘wellbeing’ with fines of up to $ 2,500 per offense.

The financial services company, which has repeatedly deplatformed organizations and individual commentators for their political views, will expand its ‘existing list of prohibited activities’ on November 3.

Among the changes are prohibitions on ‘the sending, posting, or publication of any messages, content, or materials’ that ‘promote misinformation’ or ‘present a risk to user safety or wellbeing.’ Users are also barred from ‘the promotion of hate, violence, racial or other forms of intolerance that is discriminatory.’”

According to the notice, the determination of what could be deemed “misinformation” was to be at the sole discretion of PayPal, and the fine was to be “debited directly from your PayPal account.”

It’s worth noting that undefined “misinformation” wasn’t the only thing that could incur a fine; item (i) of the policy also included materials “otherwise unfit for publication.”14 Unfit? What could that be? Your guess is as good as mine.

Based on whom they’ve deplatformed and seized funds from so far, people who would see thousands of dollars swiped from their PayPal accounts as fines for wrongthink would include anyone who doesn’t care for global tyranny, censorship, government overreach, forced medical interventions, nuclear war, The Great Reset or pedophile grooming of children, just to name a few.

PayPal Temporarily Backtracked Amid Backlash

The updated terms of service resulted in thousands of users swiftly closing their accounts and taking their outrage to social media. PayPal’s former president, David Marcus, referred to the new terms as “Insanity,”15 and company stocks tanked nearly 12%.16

The backlash was so great, PayPal backtracked the very next day and apologized for causing “confusion,” claiming the new terms of service had been sent out “in error.” According to a PayPal spokesperson:17

“An [Accepted Use Policy] notice recently went out in error that included incorrect information. PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy. We’re sorry for the confusion this has caused.”

Anyone who believes PayPal would send out new terms of service by mistake is truly gullible. A company like PayPal would have to go through multiple steps and levels of organization, including legal, in order to update its terms of service. No doubt it was approved and authorized at the highest levels.

It was not a mistake, and its sudden U-turn was merely for show (more on that in a moment). They realized they moved a bit too far, too fast, by tying the fine directly to “misinformation.” So, they backtracked.

Surprise! Fines Have Been on the Books for a Year Already

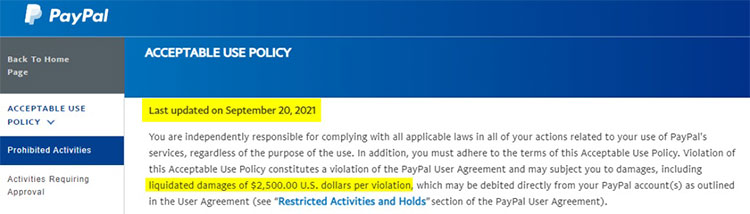

Unbeknownst to many, the $ 2,500 fine has actually been part of PayPal’s terms of service since September 20, 2021, at the latest — and it still remains. What!? Yes.

Here’s the deal: PayPal is not removing the possibility of robbing you of $ 2,500. The supposed “mistake” in language was the addition of “misinformation” as a fineable offense to an already existing policy that says they can issue fines of up to $ 2,500 for noncompliance with its use policy. In other words, they merely delayed the implementation of fines for misinformation specifically. Tech Dirt explains:18

“… PayPal’s Acceptable Use Policy already includes a claim that if you violate its policy they can take $ 2,500 from your account. While PayPal walked back some of these newly announced changes (we’ll get to that in a second), the policy about the $ 2,500 has existed for at least a year.

Here’s the policy I just grabbed from their website, showing it was last updated on September 20, 2021, with the $ 2,500 ‘liquidated damages’ clause in there:

… Lots of sites reported that PayPal had retracted its plan to fine people $ 2,500 for misinformation, but the $ 2,500 amount is still in the policy. It’s just that the misinformation part is not going live — yet.

Of course, this raises another question: if the $ 2,500 liquidated damages thing has been in there since at least 2021… has PayPal ever actually done that? … The fact that the $ 2,500 damages clause is still in the PayPal policy today still seems like a pretty big deal.

Hiding the fact that a company might take $ 2,500 from you by burying it in an acceptable use policy no one is going to read seems like not a great thing, whether or not the policy includes ‘misinformation’ as a triggering event.”

PayPal Reverses Course Again — Fines Are Back

But the story doesn’t end there. After backing off its thought police policies for a short while, PayPal turned around and doubled down on them October 27, 2022. As reported by The Gateway Pundit:19

“Paypal’s policy of charging $ 2,500 for spreading ‘inaccurate or misleading information’ has been reinstated as outlined in the Restricted Activities under the User Agreement …

Starting November 3, 2022, PayPal is expanding the existing list of prohibited activities to include the sending, posting, or publication of messages, content, or materials under its Acceptable Use Policy.

‘Violation of this Acceptable Use Policy constitutes a violation of the PayPal User Agreement and may subject you to damages, including liquidated damages of $ 2,500.00 U.S. dollars per violation, which may be debited directly from your PayPal account(s) as outlined in the User Agreement,’ said PayPal.

Users will be subject to a financial penalty if they violate the revised policy in any way, including by spreading false information, engaging in discrimination against the LGBTQ community, posing a risk to user safety, and so on … They just lied to you. PayPal is not to be trusted.”

Don’t Wait, Ditch PayPal Today

Do you really want to entrust your money to an activist organization intent on stealing your funds at the first opportune moment? I cannot encourage you strongly enough to ditch PayPal.

They have repeatedly proven they are against Constitutional rights and are willing to use their leverage in people’s lives to impose their own anti-American, anti-Constitutional and anti-humanitarian ideologies.

Understand that by using them, you’re supporting all of those things as well. Furthermore, make no mistake, PayPal is part of the blossoming social credit system,20 and that must be nipped in the bud, sooner rather than later.

Call on Lawmakers to Take Action

Getting out of PayPal as quickly as possible is not enough. As noted by Revolver news, we also need to call on lawmakers to step in and make sure PayPal and other banking and financial transaction services can never implement theft of users’ funds based on ideological differences:21

“Don’t be fooled by PayPal’s fakeout. The company wants your money, and it wants wokeness, and it’s planning on how to take both. And unless it is punished quickly, other banks will look to do the same thing …

Saturday afternoon, just a day after the planned changes broke, PayPal walked everything back, pathetically suggesting that the changes to its terms of service were the product of a typo. ‘Oops! Sorry about the mistake! Now please move along and stop asking questions.’

Obviously, only an idiot would believe this. Friday’s leaked policies were no stray typo, but the product of substantial work. And there was nothing shocking about them. For years, PayPal has increasingly let political priorities override neutral business practices …

PayPal trying to outright steal the money of non-woke users is just the rational culmination of the company’s priorities. This time, at least, some shouting on Twitter was able to reverse the policy before it began. But there is no reason to let things stop there.

Lawmakers and regulators should act immediately make sure PayPal can never consider reimposing such a policy … This isn’t just about PayPal. PayPal’s justification for confiscating its users’ assets could likely be copied by any bank with sufficient political motivation. And according to one notable finance and tech investor … there are ‘high odds’ other banks will adopt similar policies sooner rather than later …

[F]ortunately, the fix is easy. There are a whole raft of laws that any state can pass right now to protect their citizens from unjust monetary seizures or financial deplatforming:

- Decree that no person’s account may be frozen or forcibly closed absent evidence of an actual crime.

- Ban any predefined fines in excess of some nominal amount (such at $ 40) suitable for covering things like overdraft fees. For any larger amount, a company must sue in court for damages.

- Legally clarify — and have state regulators issue guidance — that ‘reputational’ risk-management frameworks for financial institutions should, as a matter of policy, consider only the reputation for solvency. Not ‘environmental,’ ‘social,’ or political matters. Prohibit banks from collecting any liquidated damages for so-called reputational harm.”

Financial Institutions Must Act as Servants

The Washington Examiner has expressed the same ideas, stating:22

“A congressional investigation of PayPal is in order … Companies that handle other people’s money should not be permitted to use their position to steal or to leverage the personal freedom of their clients. Much like government, they are supposed to be the servants and not masters of their customers.

Before PayPal and other companies attempt to establish some kind of unaccountable social credit system, they should worry about the reputational harm they will cause to themselves when they get caught.”

Deseret News has also published an article23 discussing the need for new laws. “Access to the financial system regardless of one’s views is a human-rights issue for our time,” Deseret writer Valerie Hudson wrote. In March 2021, Sen. Kevin Cramer introduced the Fair Access to Banking Act24 (S563), which could act as a foundation upon which to build further. As noted by Hudson:

“The proposed Fair Access to Banking Act is a good start, but in light of PayPal’s antics, this legislation should be strengthened and prioritized. In the United States, your life should not be held hostage by financial organizations on the basis of your political viewpoints, period.”

A Foreshadowing of a Future Hell

PayPal’s tactics foreshadow what we can expect from a central bank digital currency (CBDC). As noted by The Hill,25 “PayPal just gave America an eerie glimpse into the future.” So, we not only need legislation to prevent social engineering by the likes of PayPal, we also need laws to prevent the future use of CBDCs as a tool for mass control — which is precisely their intended function.

If we can get our representatives to understand the stakes, we could nip that preplanned tyranny in the bud. Combined with a social credit system, CBDCs will be like PayPal at its most egregious, on steroids.

A CBDC will have the ability to control where and when you spend every dime. It will also have the ability to automatically withdraw taxes and fines for crimethink and unapproved behavior. To understand what awaits us in the West, all you have to do is look at the Chinese social credit system,26 and how it controls people through a combination of financial, social and physical threats.

CBDCs can also be preprogrammed by the issuer to restrict how the currency is used by the receiver from the get-go. Discrimination and wrecking of lives for the purpose of quelling dissenting ideologies are a given under such a system.

Anyone who wants their children to grow up free have a duty to resist this financial reset, and that includes not using platforms like PayPal, which promises censorship rather than freedom. Getting laws on the books ahead of time could also go a long way toward minimizing the number of martyrs required to keep ultimate tyranny at bay.